2024-10-30

Hydrogen energy is a less common clean energy source that produces neither additional pollution nor carbon dioxide emissions during use. In addition, hydrogen has an energy density of up to 140MJ/kg, which is 4.5 times that of coal and 3 times that of oil, and is currently considered to be one of the ultimate energy sources for the realization of a zero-carbon society. Since the issuance of the "Medium and Long-term Plan for the Development of Hydrogen Energy Industry (2021-2035)" in 2022, the strategic position of hydrogen energy in the domestic industry has been basically established. Up to now, more than 20 provinces across the country have issued more than 200 hydrogen energy plans and guidance, and more than 30 industrial enterprises above designated size in the whole industry chain. The hydrogen energy industry has gradually formed a number of powerful clusters in China's Yangtze River Delta, Guangdong-Hong Kong-Macao Greater Bay Area, and Bohai Rim.

The hydrogen energy industry chain can be divided into: upstream hydrogen production→ midstream hydrogen storage and refueling→ downstream hydrogen

According to the China Hydrogen Energy Alliance, by 2025, the output value of China's hydrogen energy industry will reach 1 trillion yuan; By 2050, the demand for hydrogen will be close to 60 million tons, and the carbon dioxide emission reduction will be about 700 million tons, hydrogen energy will account for more than 10% of China's terminal energy system, and the annual output value of the industrial chain will reach12 trillion yuan. With a large number of central enterprises taking the lead in laying out the hydrogen energy industry chain, the era of hydrogen energy is coming.

|

Industry objectives |

Near-term goals (2020-2025) |

Medium-term goals (2026-2035) |

Long-term goals (2036-2050) |

|

Proportion of hydrogen energy (%) |

4% |

5.9% |

10% |

|

Hydrogen demand (10,000 tons) |

~3,000 |

~4,000 |

~6,000 |

|

Industrial output value (100 million yuan) |

10,000 |

50,000 |

120,000 |

|

Hydrogen refueling station (seat) |

200 |

2,000 |

12,000 |

|

Fuel cell vehicles (10,000 units) |

5 |

130 |

500 |

|

Stationary power supply/power station (seat) |

1,000 |

5,000 |

20,000 |

|

Fuel cell system (10,000 sets) |

6 |

150 |

550 |

Data source: Compiled by Ruibo New Materials

Just as lithium batteries are the "heart" of the lithium battery industry chain, the importance of fuel cells to the hydrogen energy industry is self-evident. Before fuel cells powered vehicles, hydrogen was already an indispensable raw material in industry. The need for green hydrogen to replace traditional grey hydrogen in industrial production is also worth paying attention to. Therefore, driven by various factors such as policy, demand, and technology, the entire industrial chain of the hydrogen energy industry will usher in new changes.

Upstream hydrogen production – an alternative to grey hydrogen is imperative

At present, there are three main ways to produce hydrogen:

(1) Hydrogen production from fossil energy reforming represented by coal and natural gas;

(2) Hydrogen production from industrial by-product gas represented by coke oven gas, chlor-alkali tail gas and propane dehydrogenation;

(3) Hydrogen production by electrolysis of water.

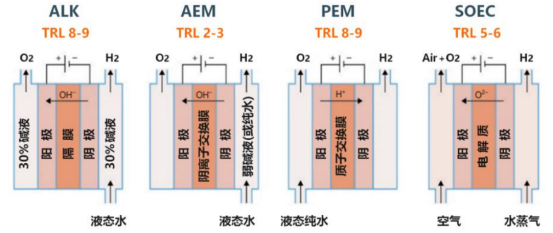

Water electrolysis to hydrogen is the only technology to produce hydrogen from renewable energy. According to the data of the China Hydrogen Alliance in 2020, hydrogen production by water electrolysis accounts for less than 2%. In recent years, the vigorous development of new energy sources such as wind power and photovoltaic has brought more possibilities for the development of hydrogen production by electrolysis of water, which is still in the early stage of development, and the market substitution space will be very broad in the future. At present, there are four technical paths for hydrogen production by water electrolysis, and ALK (alkaline electrolyzed water) and PEM (proton exchange membrane electrolyzed water) are the most important research and development directions.

Four major water electrolysis technologies for hydrogen production

Source: Hydrogen Energy Committee of China Energy Conservation Association

Hydrogen storage and transportation in the midstream – a bridge between upstream and downstream

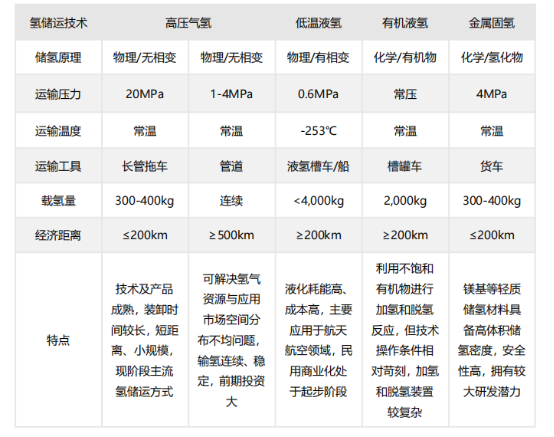

The storage and transportation of hydrogen energy plays a role in connecting the upstream and downstream of the industry. The development of safe and efficient hydrogen storage and transportation technology is the key to realizing the economic development of the hydrogen energy industry. The storage methods of hydrogen are divided according to the principle of hydrogen storage, which mainly includes physical hydrogen storage and chemical hydrogen storage. Among the physical hydrogen storage technologies, high-pressure gaseous hydrogen storage has been used on a large scale, while low-temperature liquid hydrogen storage is in the trial period. Chemical hydrogen storage technology is in its infancy, and new technologies such as solid metal hydride hydrogen storage and organic liquid hydrogen storage are also in the R&D and exploration stage.

Hydrogen transportation methods can be divided into solid, liquid, and gas according to the state of matter, and can be divided into trailers, tankers/boats, and pipelines according to the means of transportation. Different hydrogen transport modes can be used for hydrogen conditions and transport distances. Different hydrogen transportation methods have different levels of technical maturity, application scenarios, and use costs, and each has its own specific advantages and disadvantages

Comparison of parameters of main hydrogen storage and transportation technologies

Data source: Shiyin

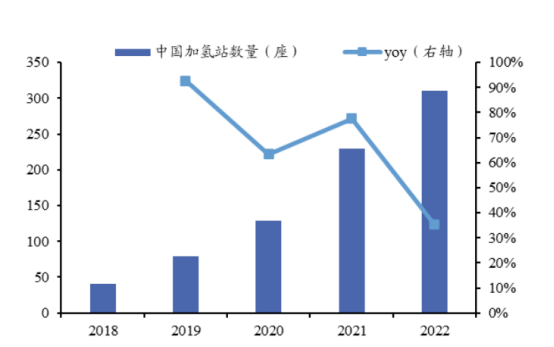

Midstream hydrogen refueling - the number of hydrogen refueling stations in China ranks first in the world

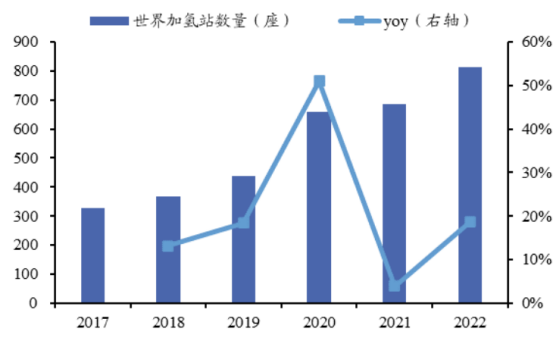

A hydrogen refueling station is a special place for filling hydrogen storage cylinders for hydrogen fuel cell vehicles, hydrogen internal combustion engine vehicles, or hydrogen-natural gas hybrid vehicles. In order to ensure energy demand, China has planned and built hydrogen refueling stations on a large scale, and in 2022, China has built more than 270 hydrogen refueling stations, ranking first in the world. The technical barriers to the construction and operation of hydrogen refueling stations are high, and the core technology and equipment are in the process of localization, and there is still room for improvement in filling pressure and capacity. With the introduction of the standard system and the gradual liberalization of policies such as hydrogen refueling station licenses, the midstream storage, transportation and hydrogen refueling links will usher in development opportunities.

As of 2022, the cumulative number of hydrogen refueling stations in the world has reached 814

Source: H2stations, Guotai Junan Securities Research

The number of hydrogen refueling stations in China is growing rapidly

Source: GGII, Guotai Junan Securities Research

Downstream hydrogen - from the car to the ordinary people's homes

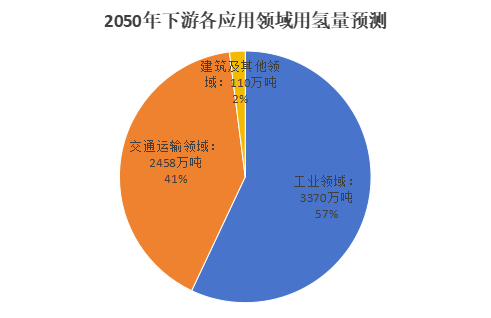

Hydrogen energy has a wide range of applications, involving four major fields: transportation, industry, electric power, and construction. In other words, the future demand growth of hydrogen energy will not only be in the substitution of green hydrogen, but also occupy an important position in the energy structure of countries around the world in the future. According to the "White Paper on China's Hydrogen Energy and Fuel Cell Industry 2020", the demand for hydrogen energy will increase to about 60 million tons by 2050, accounting for 10% of China's terminal energy system, of which hydrogen in industry, transportation, construction and other fields will account for 57% and 41% respectively and 2%. If the goal of carbon neutrality is achieved by 2060, the annual demand for hydrogen will increase to about 130 million tons, accounting for 20% of China's final energy system.

Data source: Soochow Securities

Follow Us